So, how do you keep up? If all you’re doing is checking your business account balance periodically, you may be missing out on a number of opportunities to maximize your revenue. Unless you’re generating some really serious revenue, you probably don’t have dedicated marketing, HR, or finance departments to help you check off the to-do list. Your business thrives on positive reviews, so chances are your top priority is ensuring the best customer experience possible. Anything and everything to do with day-to-day operations fall squarely on your shoulders inventory management, hiring, training, customer service, advertising, and on and on.

Divvy, meanwhile, touted impressive numbers as part of its last funding round announcement, reporting that “it had reached $100 million in spend through its service in its first 18 months of business,” according to TechCrunch.If you run a small to midsize business, you know the drill. Its performance as a public company has been mostly seen as a success since it debuted in 2019. That’s a bit irregular typically, public fintech companies have made a few acquisitions during its time as a private company.Īs of this morning, ’s market is a touch above $11 billion. Notably, does not seem to have made any other acquisitions (or at least no acquisitions worth noting by the press and private capital databases). If the sale of Divvy to was to go through, a number of well-known venture firms- New Enterprise Associates, Paypal Ventures, Insight Partners, Tiger Global Management and others-would be adding another, likely successful, exit to their portfolio. Forbes reported that, although the acquisition price is not known, has floated paying $2 billion or more for Divvy in past exploratory conversations. The startup, founded in 2016 by Alex Bean and Blake Murray, has raised $417.5 million across five publicly known funding rounds. The corporate expense management platform, as of today, is reportedly worth a pre-money valuation of $1.6 billion, according to Crunchbase. This article has been updated to reflect recent breaking newsĪccording to Forbes’ Eliza Haverstock and Alex Konrad, may announce its acquisition of Utah-based Divvy when it reports its first-quarter earnings tomorrow. 30, subject to regulatory approvals and closing conditions.

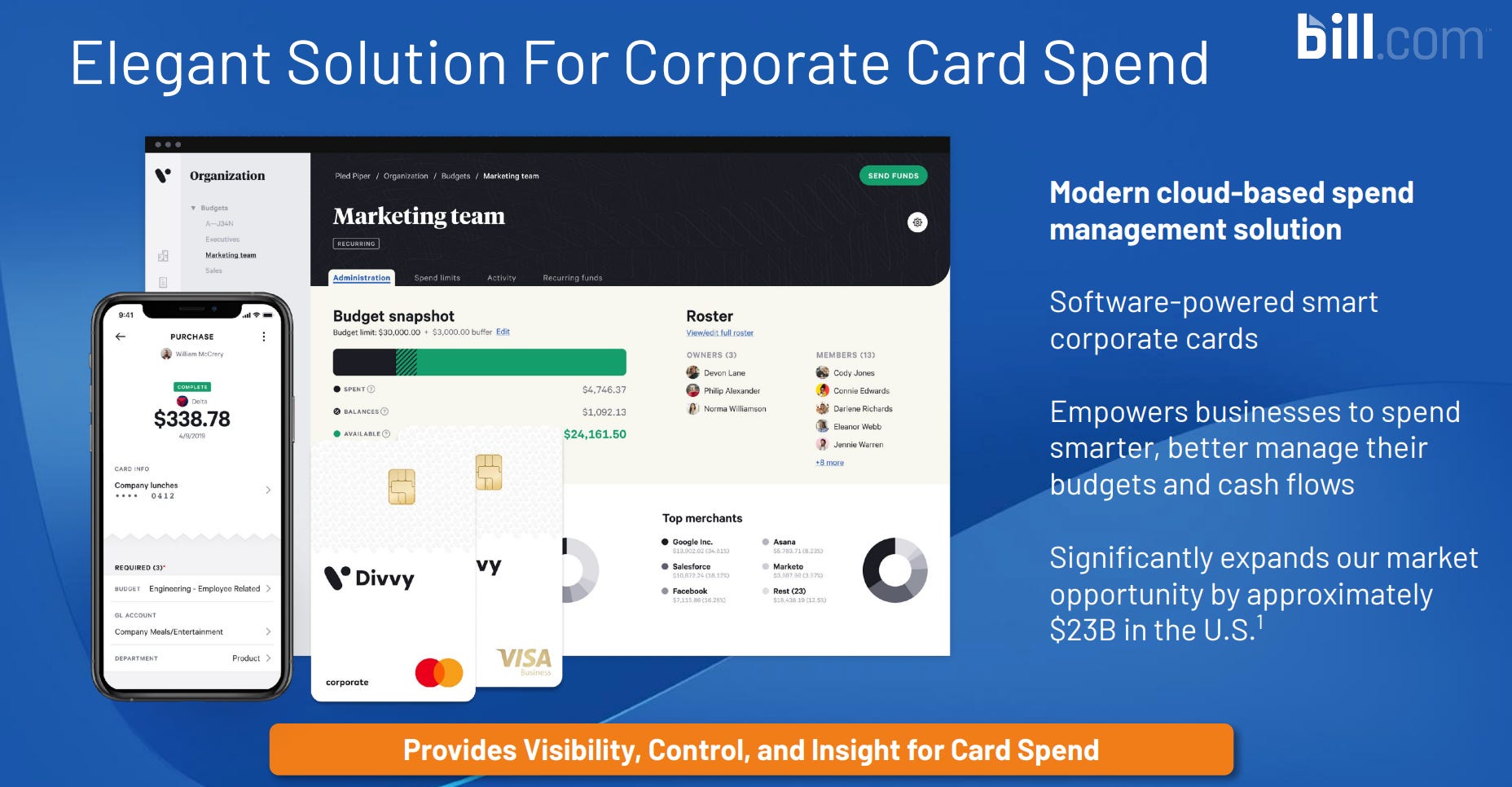

The transaction is expected to close by the end of Sept. Our expanded platform will provide more automation and real-time information to SMBs, enabling them to make more informed decisions,” René Lacerte, CEO and Founder, said in a statement. “Customers have been asking us to help them with their spend management, and I am excited that together with Divvy, we can deliver on that ask, furthering our vision to transform SMB financial operations. will acquire Divvy for about $625 million in cash and $1.875 billion of. The acquisition will enable ’s offerings to be expanded to let businesses automatically manage accounts payable, accounts receivable and corporate spend. has entered into a definitive agreement to acquire Divvy in a stock and cash transaction valued at about $2.5 billion, according to a press release.

0 kommentar(er)

0 kommentar(er)